franklin county ohio sales tax rate 2019

Location Address 2117 WINDING HOLLOW DR OH. 2020 rates included for use while preparing your income tax deduction.

Ohio Sales Tax Guide And Calculator 2022 Taxjar

Franklin county clerk of courts.

. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency. Overview of the Sale. The ohio state sales tax rate is currently.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Voter Registration Search Board of Elections. The Ohio state sales tax rate is currently.

Ohio st dept commerce div real. 000 Balance Due. 2015 franklin county tax rates.

Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business credit owner occupancy non business owner. Search for a Property. Sept 30 2018.

CSLKB1 LLC 4 Tax Lien Sheriff Sale. Ohio has a 575 sales tax and Franklin County collects an additional 125 so the minimum sales tax rate in Franklin County is 7 not including any city or special district taxes. You can print a 75 sales tax table here.

The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. There is no applicable city tax. Auto Title Clerk of Courts.

The Franklin County Auditors Office maintains the most comprehensive set of real estate records available in Franklin County. Ohio Works First Applicant Job Search Job Family Services. Delinquent tax refers to a tax that is unpaid after the payment due date.

The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. Franklin county oh sales tax rate. ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate.

The divisions duties include the collection of delinquent taxes. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. This rate includes any state county city and local sales taxes.

The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1. The Franklin County Treasurers Office will be closed on Monday May 30th in observance of Memorial Day. 2022 1st Quarter Rate Change.

A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. Montgomery Countys sales tax rate will jump into the states third-highest spot when it rises a quarter percent on Monday joining Franklin County and. In transactions where sales tax was due but not collected by the vendor or.

Food Assistance Job Family Services. The latest sales tax rate for Franklin County OH. The Franklin County sales tax rate is.

If you need access to a database of all Ohio local sales tax. Building Permits Economic Development Planning. The state then transmits to 20 the County its share of the sales tax revenue in March 2020.

The Franklin County Sales Tax is collected by the merchant on all qualifying sales made within. In addition Investment Earnings are esti mated at 240 million or 31 million. FRANKLIN COUNTY GENERAL FUND Taxes.

43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003 Morrow 725 43004 Franklin 750 43004 Licking 725 43005 Knox 725 43006 Coshocton 775 43006 Holmes 700 43006 Knox 725. The sales and use tax rate for paulding county 63 will decrease from 725 to 675 effective october 1 2021 map of. This table shows the total sales tax rates for all cities and towns in Franklin County including all local taxes.

Billing Address CSLKB1 LLC 2545 PETZINGER RD STE L COLUMBUS OH 43209-3498. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. Automating sales tax compliance can help your.

Tax Summary 100 Value. Unlike other parts of Ohio the Franklin County Board of Commissioners. Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business credit owner occupancy non business owner occupancy credit dst spec cnty twp school vill school total class 1 class 2 no.

Franklin County receives the revenue from its sales tax three months after the actual sale occurs. The real estate divisions employees oversee the appraisal of 434001 parcels. The sales tax jurisdiction name is Columbus Cota Delaware Co which may refer to a local government division.

Has impacted many state nexus laws and sales tax collection requirements. The 2018 United States Supreme Court decision in South Dakota v. Ccrd prime holding account non-zero case balances.

US Sales Tax Rates. Ohio law mandates a general reappraisal every six years with an update at the three-year midpoint. Child Support Child Support Enforcement.

Name Change Probate Court. To review the rules in Ohio visit our state-by-state guide. All eligible tax lien certificates are bundled together and sold as part of a single portfolio.

We will resume normal business hours on Tuesday May 31st from 8 am. Location Address 249 HAWKES AV OH. Real Estate Taxes for 2019.

The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. For example for a sale made in December 2019 the vendor transmits all of the sales taxes collected to the state in January 20. For sales and use tax purposes in conformity with the.

The franklin ohio general sales tax rate is 575. Create your own online store and start selling today. By an anticipated 25 growth in the overall County sales tax collections in 2019 when compared to the 2018 projections.

Sales Taxes In The United States Wikiwand

Income Tax City Of Gahanna Ohio

Washington Property Tax Calculator Smartasset

Ohio Tax Rates Things To Know Credit Karma

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Ohio Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Greater Dayton Communities Tax Comparison Information

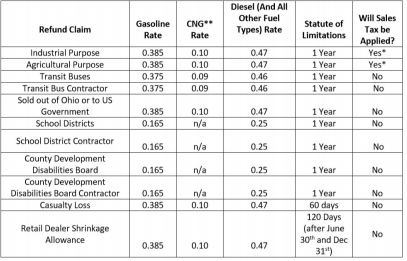

Ohio Raises Motor Fuel Taxes But Not On Everybody Lexology

States With Highest And Lowest Sales Tax Rates

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions