ev tax credit 2022 california

What Is the New Federal EV Tax Credit for 2022. This credit applies to all.

Both of the new bills have refundable tax.

. Which would increase the maximum electric vehicle tax credit to 12500 in 2022. The exceptions are Tesla and General Motors whose tax credits have been phased out. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Electric Vehicles Solar and Energy Storage. For more information and program FAQs please visit the CVRP official website or contact CSE. California is lowering its MSRP limit and income cap for EV subsidies which offers 2000 USD.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. Elon Musk SolarCity Delaware Trial Postponed Due to COVID-19 Outbreak. Currently the plug-in electric drive vehicle tax credit is up to 7500 for qualifying and eligible vehicles.

The Build Back Better bill would give EV buyers a 7500 tax credit through 2026 to charge up sales. These amounts are for Federal tax credits. Note that the federal EV tax credit amount is affected by your tax liability.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles. But the following year only electric vehicles made in the US. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000.

There is of course fine print for the EV tax incentive. Plug-in hybrid electric cars offer both gas-only and electric-only drivingeven at relatively high speeds. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

That being said California is giving credits to EV owners for an electric car home charger. Congress is mulling over passing the build back better act which would increase the maximum electric vehicle tax. This is a combination of the base amount of 4000 plus 3500 if the battery pack is at least 40 kWh.

For those that qualify Besides the generous credit for a LEVEL 2 home charger. The reason for this bill is to provide a tax credit to owners and developers of certain. Your reward will be listed on the lease or purchase agreementsimply look for a rebatenon-cash credits EV incentive manufacturer rebate or other line itembut it may be combined with.

The Center for Sustainable Energy CSE administers CVRP. Ev Tax Credit 2022 California. For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program.

The credit amount will vary based on the capacity of the. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022. The proposed electric vehicle tax credits for 2022 are refundable meaning you could potentially get money back from the government for simply buying an EV.

The following table shows the Federal tax credit and California CRVP rebate amount available for BEVs and PHEVs currently for sale in the US. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars. Local and Utility Incentives.

If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022. This incentive is not a check you receive in the mail following a vehicle purchase but rather a tax credit worth 7500 that you become eligible for. With smaller batteries than battery-electrics plug-in hybrids achieve an electric-only.

The maximum amount that their tax credit.

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Toyota S Federal Ev Tax Credits Are Drying Up

Mce Rebates For Your Electric Vehicle

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Southern California Edison Incentives

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

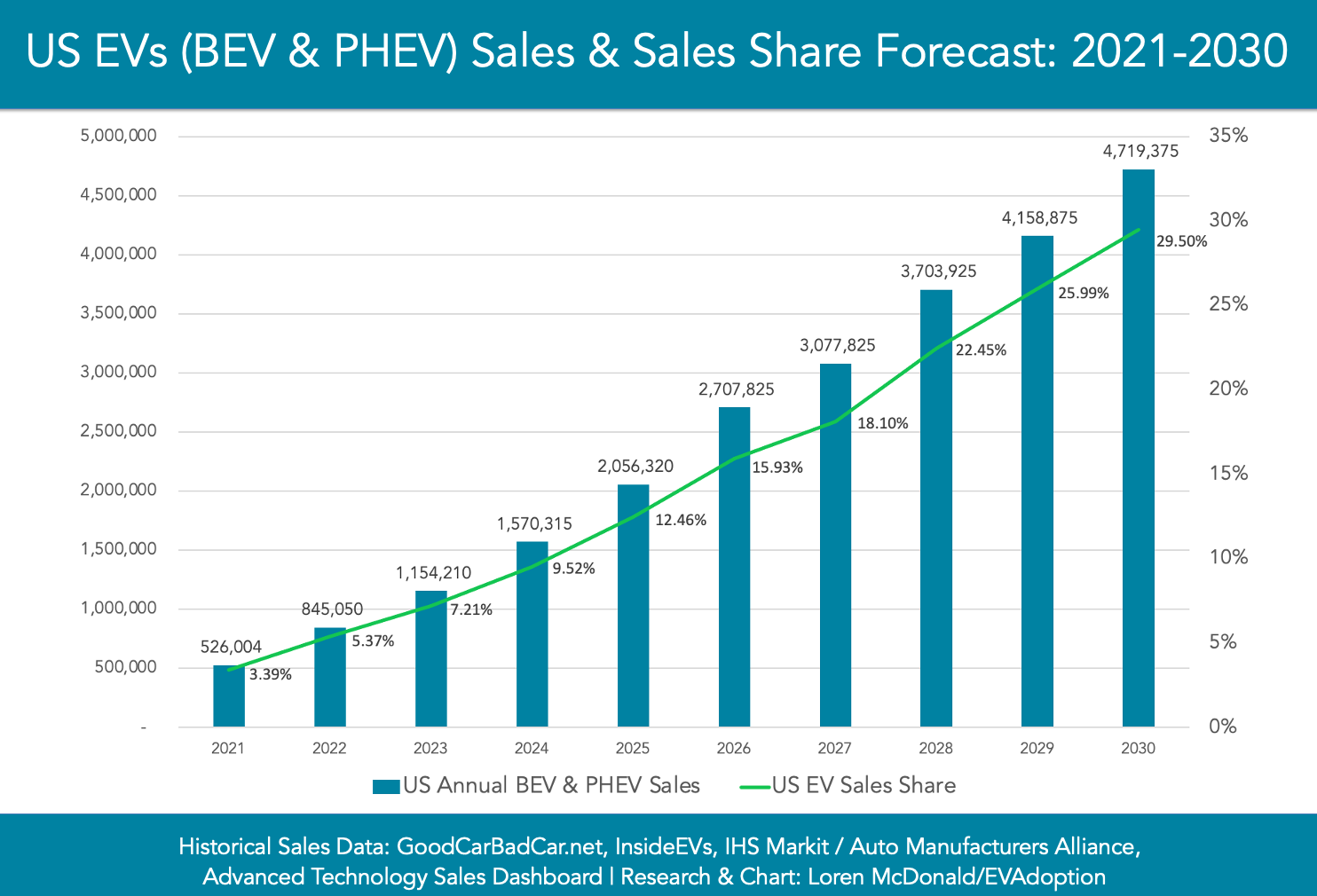

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Toyota Buyers Soon Will Lose U S Electric Vehicle Tax Credits Los Angeles Times

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Ev Incentives Ev Savings Calculator Pg E

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Latest On Tesla Ev Tax Credit March 2022

Tesla Cut From California Ev Rebate Program After Price Hikes

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The Electric Vehicle Rebate In California And Other Incentives Coltura Moving Beyond Gasoline