ny paid family leave tax code

September 2020 Business Due Dates Due Date Business Income Tax Return New York Paid Family Leave Updates For 2022 Paid Family Leave How Do State And Local Sales Taxes Work Tax Policy Center. Effective January 1 2018 PFL will provide eligible employees with up to 8 weeks of pay for a leave.

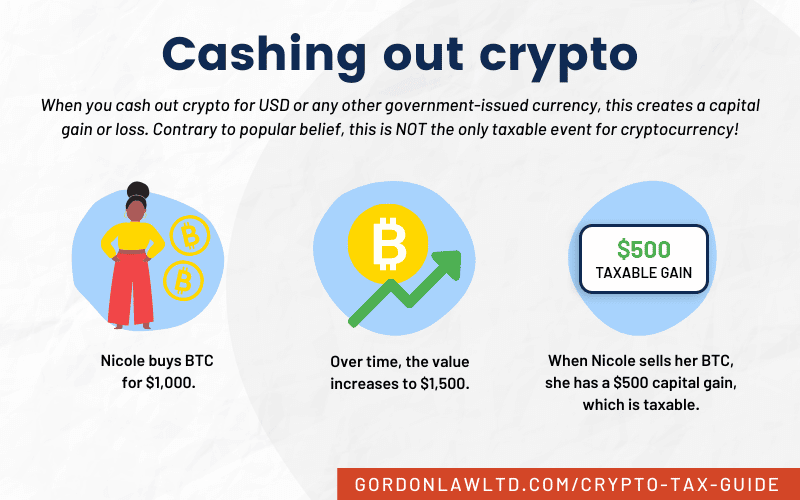

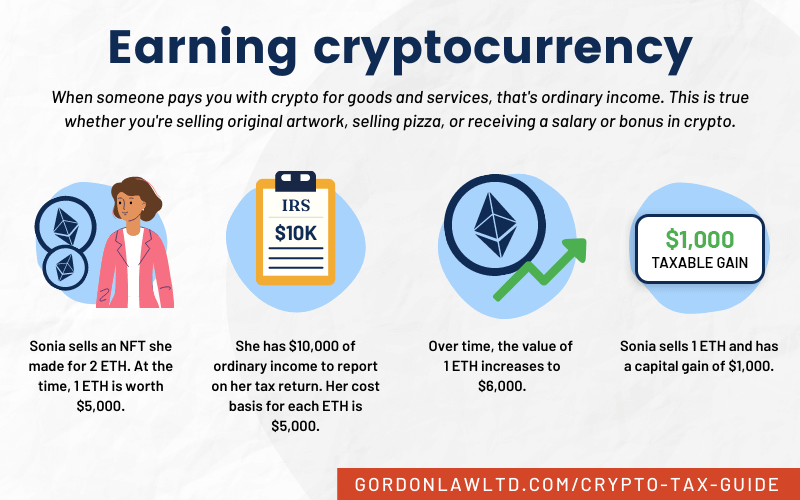

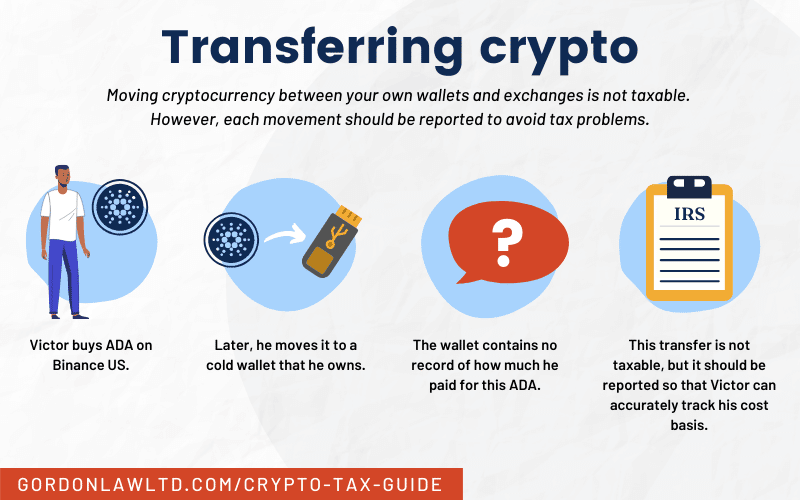

Easy Guide To Crypto Taxes For 2022 Gordon Law Group

What category description should I choose for this box 14 entry.

. In 2022 these deductions are capped at the annual maximum of 42371. ProSeries Tax Idea Exchange. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

NY Paid family leave. In the Configure Company area click Payroll then Deductions. 2 Collect employee contributions to pay for their coverage.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Paid Family Leave may also be available. Select the NYPFL code by typing NYPFL into the search box then click Save.

What category description should I choose for this box 14 entry. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. An employer may choose to pay for the Paid Family Leave benefit on behalf of employees.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. The description for this entry is PAID FAMILY LEAVE. Requirements for other types of employers are.

They are however reportable as income for IRS and NYS tax purposes. Intuit Accountants Community. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer.

Almost all employees are eligible for paid family leave and employers must give their employees paid family leave. 1 Obtain Paid Family Leave coverage. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

As of January 1 2018 paid family leave is mandatory in New York State. NYPFL in Box 14 of your W-2 should be listed under the category of Other deductible state or local tax when you are entering your W-2 on the federal screen. Select the Payroll Info tab and select Taxes.

Big changes arrived for New Yorkers on January 1 2018 when the New York Paid Family Leave NYPFL benefit went into effect. Ny paid family leave tax code Sunday March 20 2022 Edit. Employers may collect the cost of Paid Family Leave through payroll deductions.

This is 9675 more than the maximum weekly benefit for 2021. The New York State Department of Taxation and Finance Department recently released its guidance on the tax implications of the New York Paid Family Leave Benefits PLF law for New York employees employers and insurance carriers. The maximum annual contribution is 42371.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could the temporary employee file for. For 2022 the deduction will be 0511 of a covered employees weekly wage capped at 815 per week 42371 per year.

Employee-paid premiums should be deducted post-tax not pre-tax. New York State intends Paid Family Leave to be funded entirely by payroll deductions from covered employees. For the last couple of years NYS have being deducting premiums for the Paid Family Leave program.

Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. To estimate your deduction use the payroll deduction calculator. Paid Family Leave provides eligible employees job-protected paid time off to.

This deduction will appear on paychecks with the description NY FLIEE. Use the calculator below to view an estimate of your deduction. Follow the steps below to set up a NY Paid Family Leave deduction.

Called one of the most comprehensive paid family leave programs in the nation the law requires employers to allow employees to take paid job-protected leave to tend to a family member with a serious health condition bond with a new. New York designed Paid Family Leave to be easy for employers to implement with three key tasks. Pursuant to the Department of Tax Notice No.

The description have not being added on the drop down menu of the W2 worksheet forcing to list it as Other. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. New York State Paid Family Leave Hotline NY Phone.

Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Vacation and Personal Leave. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. This deduction shows in Box 14 of the W2. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation.

Employers may offer employees the option of using any accrued unused paid vacation or personal. 67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less. The state of New York communicated Paid Family Leave rates and.

The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. 2022 Paid Family Leave Payroll Deduction Calculator. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a. Click Add Deduction.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. In the Add Deduction window the required rate of 511 is automatically added.

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog

How Do Food Delivery Couriers Pay Taxes Get It Back

Double Taxation How Small Businesses Can Avoid It Smartasset

Easy Guide To Crypto Taxes For 2022 Gordon Law Group

Types Of Taxes Income Property Goods Services Federal State

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

How Do Food Delivery Couriers Pay Taxes Get It Back

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Taxes On Vacation Payout Tax Rates How To Calculate More

Indians Working Abroad Do Not Need To Pay Tax In India

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Au Pair Taxes Explained J 1 Tax Return Filing Guide 2022

How Much Tax Will I Pay If I Flip A House New Silver